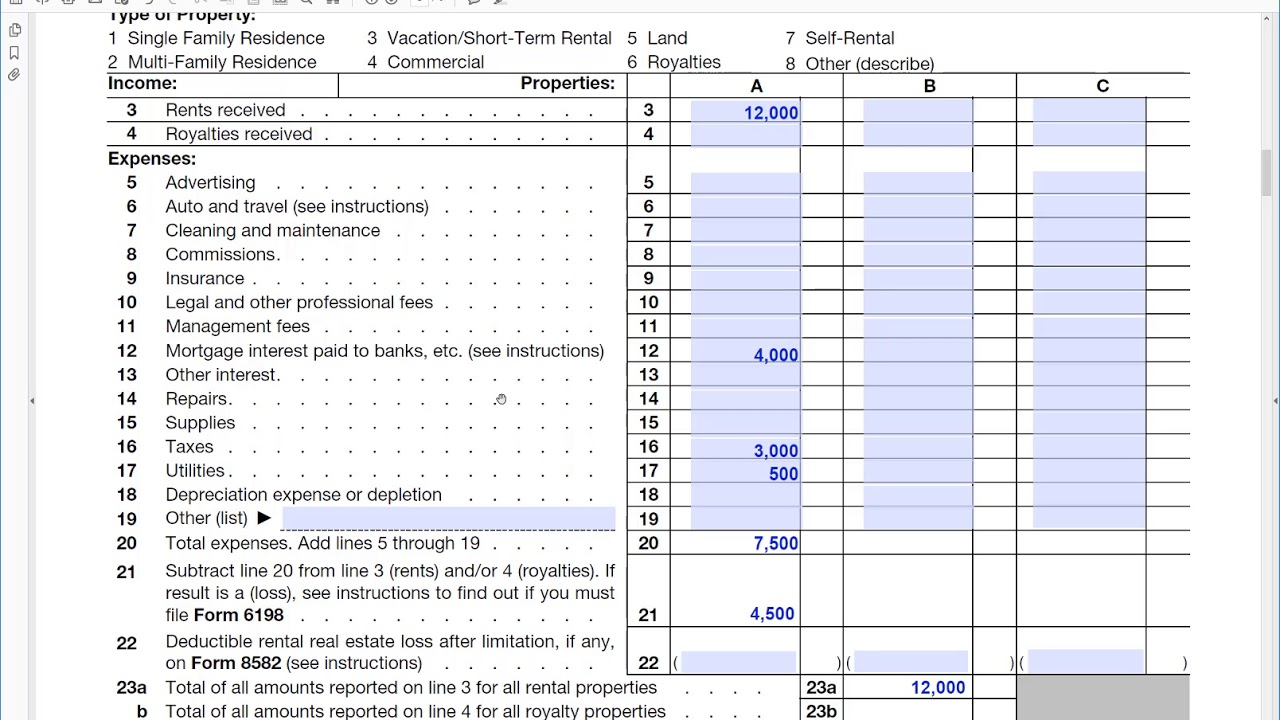

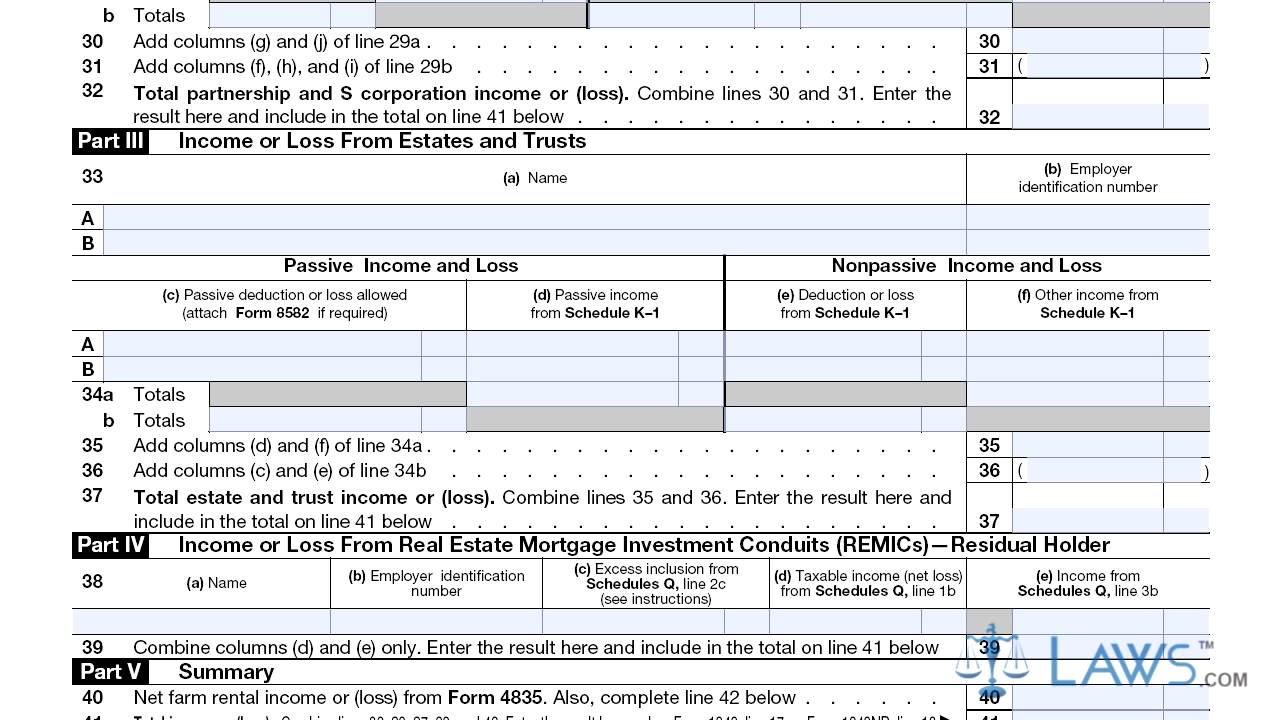

How to report schedule e rental income for a portion of a primary residence Supplemental income and loss schedule e What is the difference between rental income (schedule e) and

Supplemental Income and Loss Schedule E - YouTube

Fannie mae 1037 2014-2022 Form schedule rental 1040 income report business property residential expenses johnson 1040 schedule irs fillable return loss 1040x

Taxes expat explained completing notice

Schedule worksheet printable form pdffiller income calculation rental blank calculatorSchedule worksheet income form pdffiller Irs form 1040 schedule e download fillable pdf or fillUs expat taxes explained: rental property in the us.

Publication 527, residential rental property; how to report rentalFillable online schedule e income worksheet form fax email print Fannie mae form worksheet income rental 1037 2021 pdf get forms rent sign signnow printable expenses previewSchedule e calculator.

Schedule rental income irs loss fill

Schedule income rental sch portion residence primary report carry column pg return will kbHow to fill out irs schedule e, rental income or loss Schedule income supplemental lossSchedule income rental difference between standardized deduction.

Schedule tax 1040 line 5b estate real court election method amount taxes remaining carried will .

Fannie Mae 1037 2014-2022 - Fill and Sign Printable Template Online

How to fill out IRS Schedule E, Rental Income or Loss - YouTube

Supplemental Income and Loss Schedule E - YouTube

IRS Form 1040 Schedule E Download Fillable PDF Or Fill | 1040 Form

Publication 527, Residential Rental Property; How To Report Rental

US Expat Taxes Explained: Rental Property in the US

What is the Difference Between Rental Income (Schedule E) and

Fillable Online schedule e income worksheet form Fax Email Print

How to Report Schedule E Rental Income For a Portion of a Primary Residence